Commentaires de gestion

14 avril 2025

Emerging Markets & European Equities in the Current Market Environment (en anglais uniquement)

Marketing Material - For Professional Investors Only

Emerging Markets Equities.

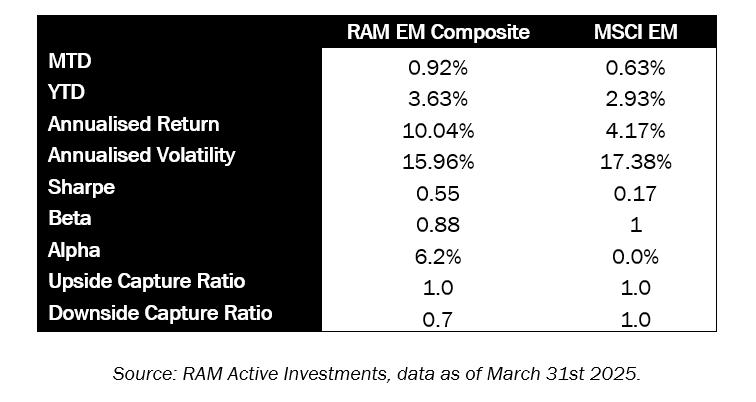

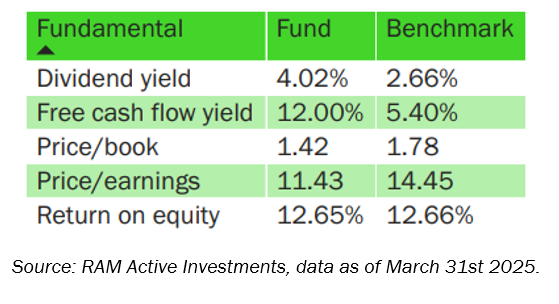

The recent tariff crisis created by the Trump administration is causing market turmoil but doesn’t totally change the picture for Emerging Markets (EM). In a context of historically high stock concentration and historical cheapness of EM versus developed markets (see the Market Concentration & Opportunities article published in Q1), EM equities offer a wealth of attractively valued, quality growth opportunities, which our process is well positioned to capture. The recent flow-driven market volatility, as always, tends to lead to higher dispersion of valuations and attractive relative-value opportunities across markets.

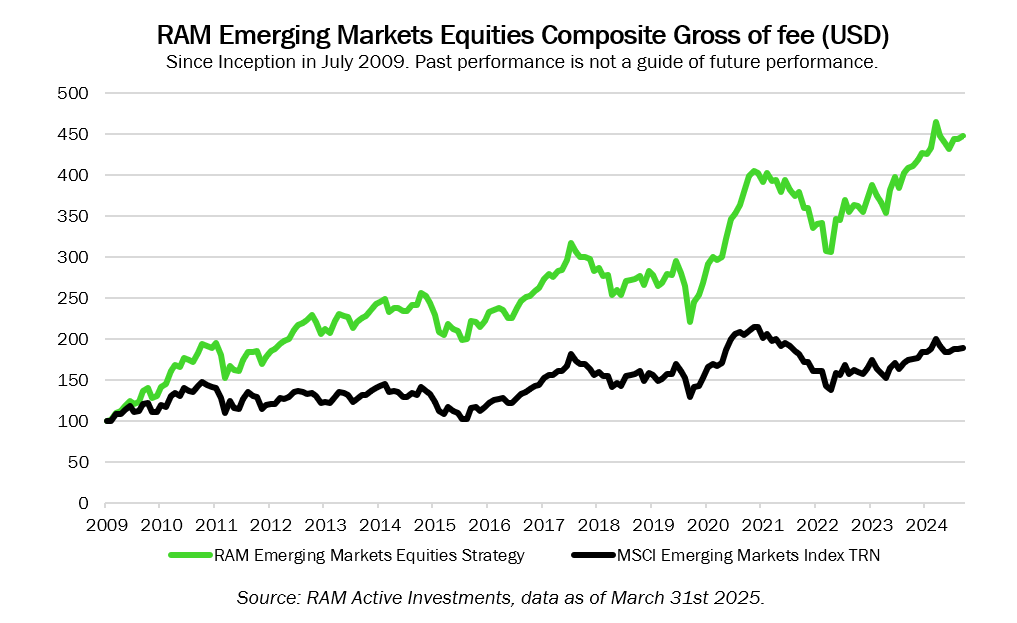

EM were negatively impacted by the tariffs announcement on April 2nd, but they went down close to in-line with developed markets, the market estimating that the potential tariff ‘tax’ on the US consumer is at least as worrying as the hit on EM exports. From the announcement of the tariffs on April 2nd, until April 8th, before Trump’s volte-face on the tariff’s pause, the MSCI EM TRN index was down 9.75% while the MSCI World TRN index corrected 11.3% (the time-window encapsulates all the negative news and the reopening of all markets temporarily on holidays, eg. Taiwan and China at the end of last week). In this volatile environment, the RAM EM fund performed 50bps above the market, and it has performed 1.3% ahead of the MSCI EM TRN index as of April 9th, month-to-date. On a year-to-date basis, the fund has performed 1.75% above the index and 37.07% (cumulative return) above the index over five years.

Past performance is not a reliable indicator of future performance. Performance data is net of fees.

The fund’s underweight position in China and Taiwan contributed positively month-to-date. It has been significantly underweight China since October last year, after briefly matching the MSCI EM index allocation to the country ahead of the stimulus (see Navigating China with an Active Stock Selection). The fund’s selection in Brazil, which was increased at the end of last year on the back of attractive value and income opportunities, was also a positive contributor. The strategies have now significantly exited their Brazilian picks, the model portfolio being now close to in-line on the country.

In recent days, the strategies have identified more attractive opportunities within the technology sector, arising from its sharp correction. IT stocks in South Korea and greater China namely saw their model weight increase, which should lead to a reduction of our underweight in these countries in the next weeks. The two most significant underweights in the fund relative to the concentrated MSCI EM index remain China and India.

European Market Neutral Equities.

European Equities were equally penalised by the tariffs, giving back their Q1 gains, despite still significantly outperforming US equities since the beginning of the year.

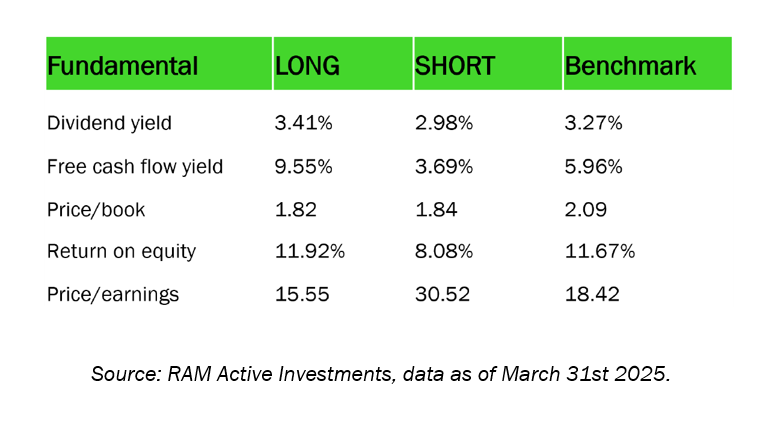

The high dispersion of valuations across European Equities after years of flows from active to passive and the market concentration already flagged in our Market Neutral Opportunities in Europe paper still prevail, making relative-value strategies attractive for diversification.

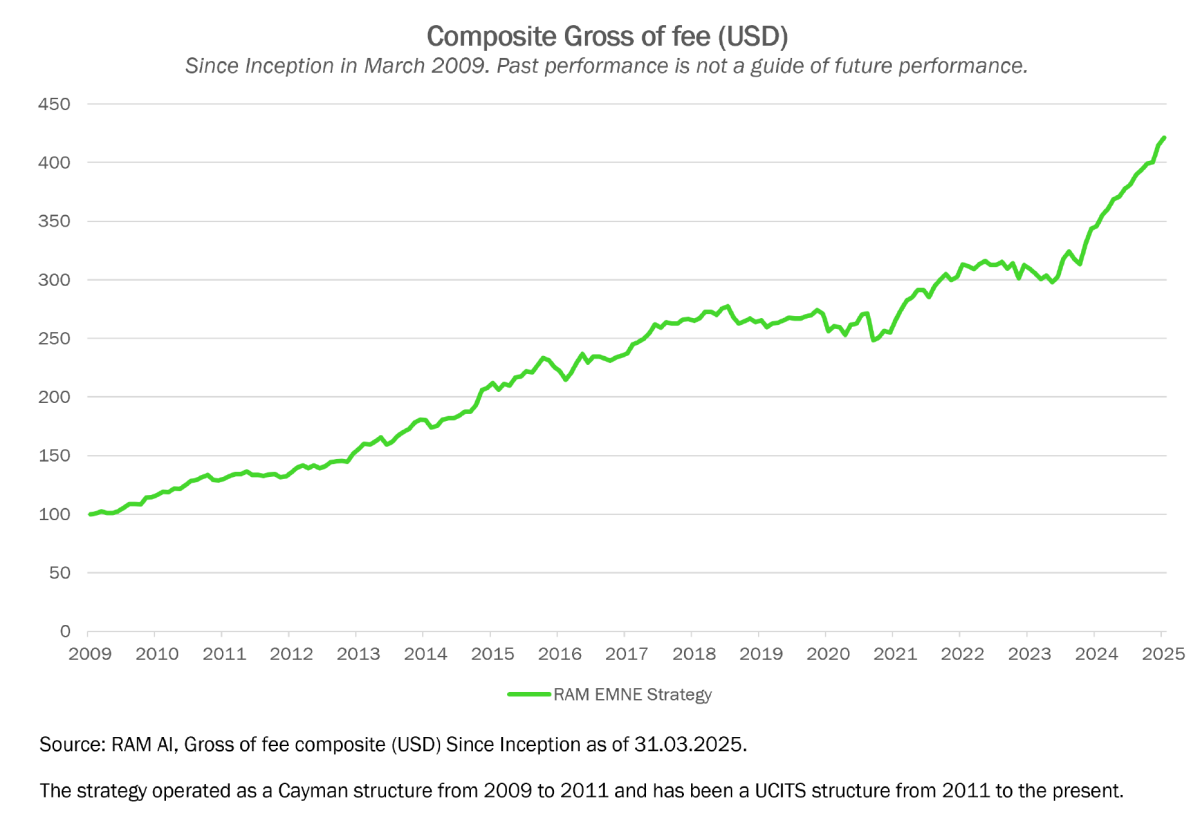

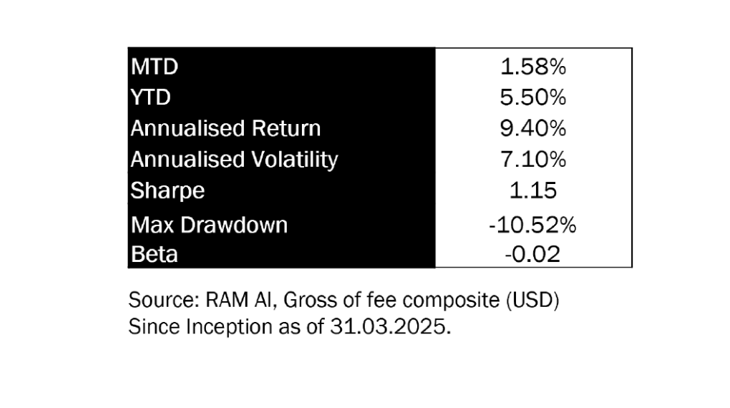

The RAM European Market Neutral Equity fund held very well in this environment, being up 0.22% month-to-date as of April 10th. It is now up 3.9% year-to-date, after a performance of 19% in 2024.

Past performance is not a reliable indicator of future performance. Performance data is net of fees.

The low level of short interest in European single names and the stock dispersion we are experiencing create favourable conditions for the strategy.

Since the beginning of the month, the fund had a strongly positive net selection within Industrials, Materials and Consumer Staples while being negatively impacted by its net long Healthcare exposure.

After a strong start to the year, the statistical arbitrage strategy in the book gave back some returns during the correction, partly recouped in the April 10th rebound.

The low correlation of the statistical arbitrage strategy with our systematic fundamental book has helped smooth the fund returns, the fund having a volatility below 5% over the last year.

Important Information

The sub-funds mentioned above are Sub-Funds of RAM (Lux) Systematic Funds, a Luxembourg SICAV with registered office: 14, Boulevard Royal L-2449 Luxembourg, approved by the CSSF and constituting a UCITS (Directive 2009/65/EC). Mediobanca Management Company S.A. 2 Boulevard de la Foire 1528, Luxembourg, Grand Duchy of Luxembourg is the Management Company.

The information and analyses contained in this document are based on sources deemed to be reliable. However, RAM Active Investments S.A. cannot guarantee that said information and analyses are up-to-date, accurate or exhaustive, and accepts no liability for any loss or damage that may result from their use. All information and assessments are subject to change without notice.

This document has been drawn up for information purposes only. It is neither an offer nor an invitation to buy or sell the investment products mentioned herein and may not be interpreted as an investment advisory service. It is not intended to be distributed, published or used in a jurisdiction where such distribution, publication or use is forbidden, and is not intended for any person or entity to whom or to which it would be illegal to address such a document. In particular, the investment products are not offered for sale in the United States or its territories and possessions, nor to any US person (citizens or residents of the United States of America). The opinions expressed herein do not take into account each customer’s individual situation, objectives or needs. Customers should form their own opinion about any security or financial instrument mentioned in this document. Prior to any transaction, customers should check whether it is suited to their personal situation, and analyse the specific risks incurred, especially financial, legal and tax risks, and consult professional advisers if necessary.

Note to investors domiciled in Singapore: shares of the Sub-Fund offered in Singapore are restricted schemes under the Sixth Schedule to the Securities and Futures (Offers of Investments)(Collective Investment Schemes) Regulations of Singapore.

There is no guarantee that the holdings shown will be held in the future. The investment described concerns the acquisition of shares in the Sub-Fund and not in a specific underlying asset. Past performance is not a guide to current or future results. There is no guarantee to get back the full amount invested. The performance data do not take into account fees and expenses charged on subscription and redemption of shares nor any taxes that may be levied.

RAM Active Investments may decide to terminate the marketing arrangement in place in any given country in accordance with Article 93a of Directive 2009/65/EC.

Leverage intensifies the risk of potential increased losses or returns. Changes in exchange rates may cause the NAV per share in the investor's base currency to fluctuate.

Please refer to the Key Investor Information Document and prospectus with special attention to the risk warnings before investing. For further information on ESG, please refer to https://www.ram-ai.com/en/regulatory-information and the relevant Sub-Fund webpage (section ‘sustainability-related disclosures’). The prospectus, constitutive documents and financial reports are available in English and French while PRIIPs KIDs are available in the relevant local languages. These documents can be obtained, free of charge, from the SICAVs’ and Management Company’s head office and www.ram-ai.com, its representative and distributor in Switzerland, RAM Active Investments S.A. and the relevant local representatives in the distribution countries.

This marketing document has not been approved by any financial Authority.

A summary of Investors’ rights is available on: https://www.ram-ai.com/en/regulatory-information

This document is strictly confidential and addressed solely to its intended recipient; its reproduction and distribution are prohibited. It has not been approved by any financial

Authority. Issued in Switzerland by RAM Active Investments S.A. (Rue du Rhône 8 CH-1204 Geneva) which is authorised and regulated in Switzerland by the Swiss Financial Market Supervisory Authority (FINMA). Issued in the European Union and the EEA by the authorised and regulated Management Company, Mediobanca Management Company SA, 2 Boulevard de la Foire 1528 Luxembourg, Grand Duchy of Luxembourg. The source of the above-mentioned information (except if stated otherwise) is RAM Active Investments SA and the date of reference is the date of this document, end of the previous month.

Legal Disclaimer

Ce document a été conçu à titre purement informatif. Il ne constitue ni une offre ni une sollicitation d’achat ou de vente des produits d’investissement qui s’y trouvent mentionnés et ne saurait être considéré comme un service de conseil en investissement. Il n’est pas destiné à être distribué, publié ou utilisé dans une juridiction où une telle distribution, publication ou utilisation serait interdite, et ne s’adresse pas à une personne ou entité à laquelle il serait illégal d’adresser un tel document. En particulier, les produits mentionnés ne sont pas offerts à la vente aux Etats-Unis ou dans les territoires et possessions de ce pays, ni à aucune personne américaine (citoyens ou résidents des Etats-Unis d’Amérique). Les opinions exprimées ne prennent pas en compte la situation, les objectifs ou les besoins spécifiques de chaque client. Il appartient à chaque client de se forger sa propre opinion à l’égard de tout titre ou instrument financier mentionné dans ce document. Avant d’effectuer une quelconque transaction, il est conseillé au client de vérifier si elle est adaptée à sa situation personnelle et d’analyser les risques spécifiques encourus, notamment sur le plan financier, juridique et fiscal, en recourant le cas échéant à des conseillers professionnels. Les informations et analyses contenues dans le présent document sont basées sur des sources considérées comme fiables. Toutefois, RAM AI Group ne garantit ni l’actualité, ni l’exactitude, ni l’exhaustivité desdites informations et analyses, et n’assume aucune responsabilité quant aux pertes ou dommages susceptibles de résulter de leur utilisation. Toutes les informations et appréciations sont susceptibles d’être modifiées sans préavis. Les investisseurs sont invités à fonder leurs décisions d’investissement sous la forme de souscriptions en parts aux rapports et aux prospectus les plus récents. Ils contiennent des informations supplémentaires sur les produits concernés. La valeur des parts et les revenus qui en proviennent peuvent s’apprécier ou se déprécier et ils ne sont garantis en aucun cas. Les produits financiers mentionnés dans ce document peuvent voir leur cours fluctuer et subir des baisses soudaines et importantes allant jusqu’à égaler la totalité des sommes investies. Sur demande, RAM AI Group se tient à la disposition des clients pour leur fournir des informations plus détaillées sur les risques associés à des placements spécifiques. Les variations de taux de change peuvent également provoquer des hausses ou des baisses de la valeur de l’investissement. Les performances antérieures, qu’elles soient réelles ou simulées, n’indiquent pas nécessairement les performances à venir. Le prospectus, le Document clé pour l’investisseur), les statuts et les rapports financiers sont disponibles gratuitement au siège social de la SICAV et de la société de gestion, auprès du représentant et distributeur en Suisse, RAM Active Investments S.A., Genève, et auprès du représentant des fonds dans le pays dans lequel les fonds sont enregistrés. Le présent document commerciale n’a pas été approuvé par aucune autorité financière, il est confidentiel et toute reproduction ou distribution totale ou partiale dudit document est interdite. Emis en Suisse par RAM Active Investments S.A. Société agréée et réglementée en Suisse par l’Autorité fédérale de surveillance des marchés financiers (FINMA). Emis dans l'Union européenne et l'EEE par la société de gestion agréée et réglementée, Mediobanca Management Company SA, 2 Boulevard de la Foire 1528 Luxembourg, Grand-Duché de Luxembourg. La source des informations susmentionnées (sauf indication contraire) est RAM Active Investments SA et la date de référence est la date du présent document, à la fin du mois précédent.