News

12 October 2022

Emerging Markets: Beyond Chinese Growth

Introduction

After a decade of Emerging Markets (EM) Equity investments going from active to passive, we believe that now is the time to reconsider the active opportunities in EM - a universe with significant dispersion in valuations.

In the last twenty years, these have been dominated by the remarkable ascent of China. As decades of overinvestment and excessive leverage are finally coming to an end, the current structural headwinds faced by China will surely continue to put pressure on Chinese Equities in the years ahead.

The current situation advocates for an active approach to EM investing, looking for investment opportunities beyond the Chinese growth, and away from passive market-cap-based approaches.

1990s-2000s - The Chinese Economic 'Miracle'

China has gone through a phase of extraordinary economic growth and technological development by any standard, averaging around 9% over the last 30 years. This makes China the largest economy in the world when looking at Gross Domestic Product (GDP) based on purchasing power parity, estimated at 30 trillion USD (IMF 2022 World Economic Outlook estimate).

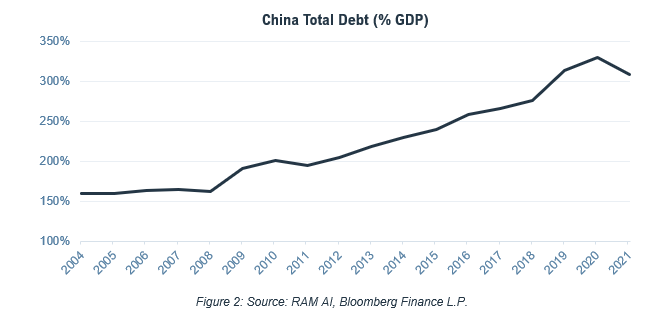

The Chinese growth miracle was significantly driven by abnormally high levels of Fixed-Capital Formation, with massive investments in real estate across Chinese regions. The real-estate speculation and investment frenzy, which was supported by local governments and greatly benefited their land sales budgets, was fueled by a very large debt increase in the Chinese economy. Debt increases in the last twenty years have been remarkable across households, corporates and local governments.

This formidable economic growth came at the price of an even more extraordinary real-estate bubble, an imbalanced economy too skewed towards investment and a now unsustainable debt load. This led to the very significant slowdown China is experiencing in 2022, which goes far beyond the constraints of COVID-19 policies…

The Chinese economy faces structural challenges at the scale Japan experienced in the 1990s, and it will certainly take years for it to rebalance towards a more sustainable path.

Investing in EM: The Chinese Equities Risk

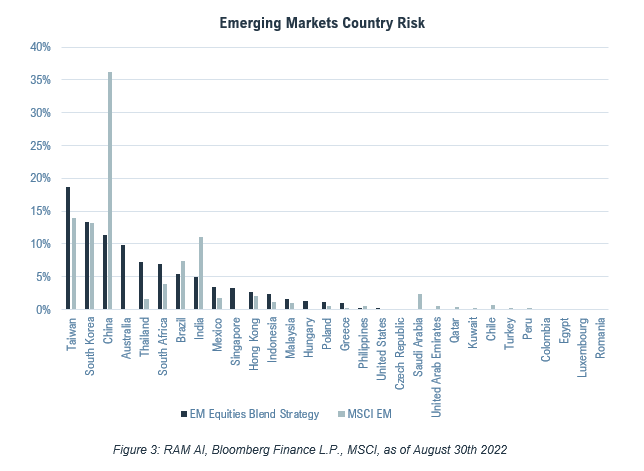

China represents more than 30% of the allocation in the MSCI Emerging Markets index and contributes to 36% of the risk in the index.

Analysing the risk contribution to the index at stock-level shows that the concentration in passive indexes at country-level coincides with an extraordinarily high risk concentration in the mega-cap names of the index.

EM Valuation

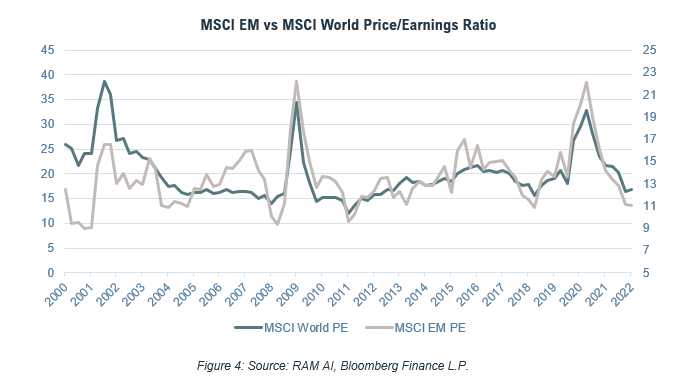

EM Equities have corrected this year on the back of both currency and stock price depreciation. Valuation levels are coming close to all-time lows in earnings valuation, which could encourage investors to step back into the asset class on any further downside, likely in the current global recessionary environment.

Active management in EM alone can help an investor take advantage of the dispersion in valuations across countries and industries of the universe.

Beyond Broad Valuations, Capturing Dispersion

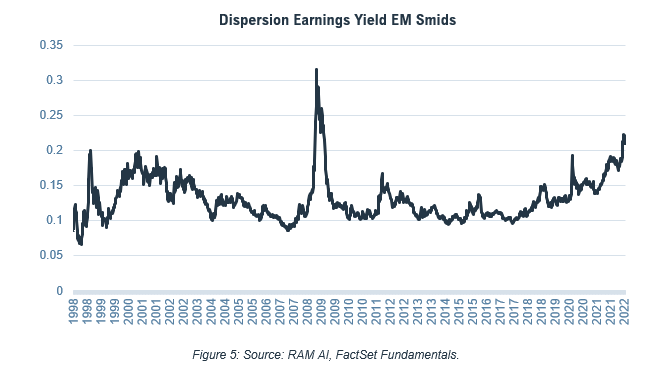

After the recent market correction, valuation dispersion has been at its highest level since the Great Financial Crisis, offering a compelling set of bottom-up investment opportunities. Active stock selection processes are the most suited to capture this compelling upside.

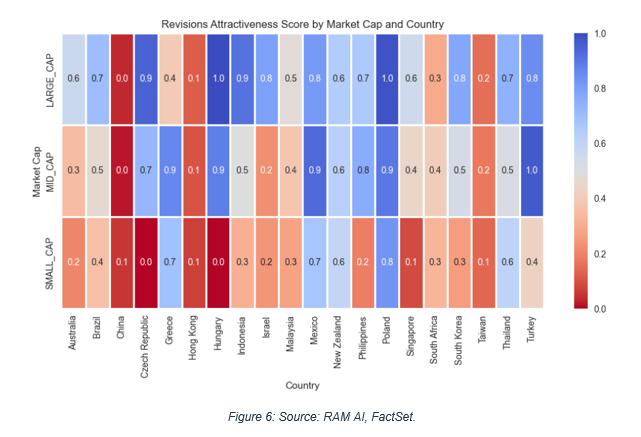

Looking at the stocks’ attractiveness across countries from the analyst revisions’ perspective of the company’s earnings and revenues, China stands out negatively, with bright spots in relative terms in Large Caps across Central Europe and Asia, particularly in South Korea and Thailand.

Conclusion

Overall, Small-Caps have the most negative revisions dynamics, hit hard by the scarcity of financing and the lower liquidity in EM, which is offset by attractive valuations in the segment after a significant underperformance this year. RAM AI’s selection within Small and Mid-Caps has a strong bias toward stocks resilient in the current downturn and a strong quality bias. The Small and Mid-Caps in the strategies tend to generate strong free cash flows and can stand on their own feet in the current stressed financing environment, which helps them significantly outperform this year.

Active selection fills the gap and looks for opportunities beyond simple style or market cap allocations, making the most of the current dispersion across EM.